Bitwise CIO Matt Hougan:Bitcoin Could hit $6.5 Million in 20 Years

Speaking to Coindesk, Matt Hougan stated that Bitcoin could reach $6.5 million within 20 years. The current value of Bitcoin is around $81,000.

Hougan views Bitcoin as a “superior version of gold.” He argues that even if Bitcoin were to capture a modest share of the global store of value market, comprised of assets like gold, real estate, and government bonds, the price could mathematically reach these levels.

One of his most striking predictions is that central banks could hold as much (or even more) Bitcoin in their reserves as gold in the future. While this idea seems radical now, he believes it’s inevitable in a 10-20 year perspective.

This prediction is based not on “accelerating adoption,” but on the assumption of rising global debt and continued devaluation of fiat currencies. In other words, as Bitcoin’s value increases, the purchasing power of currencies like the dollar decreases, making this price level possible.

He notes that Bitcoin’s volatility is decreasing, making it easier for institutional investors (pension funds, etc.) to enter the market.

Although the long-term target is $6.5 million, Hougan paints a more cautious and realistic picture for the short term:

First Half of 2026: He expects Bitcoin to trade sideways (consolidate) for a while in the $75,000 – $100,000 range.

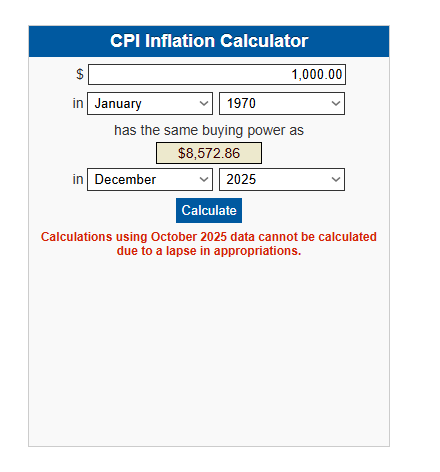

According to BLS data, when we calculate the value of $1000 in January 1970 and its value in December 2025, we see that it is equal to $8,572.86.

There is approximately an 8.5-fold difference. Based on this data, and as we are now witnessing more devaluation of currencies, Hougan may be making a good prediction. However, a price increase of approximately 65 times for Bitcoin is a very high estimate. Even if this happens, it is necessary to consider dollar inflation.

You can access the full interview from CoinDesk’s YouTube video:

This news is for informational purposes only and does not constitute investment advice.